As this is the last one of the year, it won’t be an ordinary newsletter. Today, we will be going through some of the biggest events of 2022, as well as some tier lists of people to keep in mind (one way or another). Welcome to the last Norn newsletter of the year!

The biggest events of 2022

This year has certainly been a rollercoaster for the whole industry. A rollercoaster that has been going through an endless downward spiral. Blowups have been non-stop, some bigger than others, and we’ve seen carnage in markets with Bitcoin dropping -65% and Ethereum -69% respectively.

We have also had some historical events on the positive side, such as the Merge, Ethereums transition from proof-of-work to proof-of-stake. In this newsletter we want to take the time to go through the most impactful events of the year. It’s been a pleasure to have you with us on this journey, let’s recap it here.

The collapse of FTX

In November this year (yes like 1.5 months ago) we experienced the biggest and most unexpected bankruptcy our industry has ever seen. Gigantic crypto exchange FTX filed for Chapter 11 bankruptcy after a few weeks of sheer drama on Twitter, with back and forths between CZ and SBF, countless hours of Twitter spaces and an acquisition LOI of FTX as well as a pull-out from that acquisition by Binance. This event was devastating to our industry and we are yet to have seen the full ramifications of this bankruptcy, expect more contagion going into 2023.

The Merge

Probably the biggest W for the industry in 2022, Ethereum managed to successfully transition from its previous proof-of-work consensus mechanism to proof-of-stake. This means that the network now consumes 99% less energy and the climate narrative against crypto is basically useless. A big applause to the Merge developers and everyone who contributed.

Terra Luna & 3AC collapse

Another devastating collapse, though expected by some, took many by surprise. In May we saw a $50 billion dollar market cap vanish within a few days. The algorithmic stablecoin backed by Luna, UST lost its peg, sending the native currency $LUNA to from $100+ to 0 within a few days. This lead to extreme contagion and also put the final nail in the coffin for multi-billion dollar hedge fund Three Arrows Capital.

Ukraine raises $70million+ in crypto donations

As the war between Ukraine and Russia started earlier in the year, crypto came through. Over $70 million dollars was raised within a few months, including a $5 million dollar donation from Polkadot founder Gavin Wood.

Ronin chain $600 million dollar hack

This goes down as the biggest exploit in crypto so far. In late March 2022 hackers managed to get control of the private keys to validator nodes on the Ronin chain, draining 173,600 Ether and $25.5 million USDC, totaling over $600 million at the time. The concerns regarding Ronins proof-of-authority consensus mechanism became blatantly obvious after this hack. SkyMavis has since raised rounds of $150 million + to star reimbursements.

Below you can see a graph from The Block (source) detailing the aggregated amount of dollars stolen in DeFi exploits. The huge jump you see between Jan and Jul is the Ronin hack. All in all, 2022 has been a record year for DeFi protocol exploiters.

Tornado Cash US sanctions

In August 2022 the US Office of Foreign Asset Controls added privacy protocol and mixer Tornado Cash to their sanctions list. This meant that anyone who interacts with Tornado Cash more or less becomes a financial criminal in the US. The lead developer on Tornado Cash’s open source code remains imprisoned to this day, which is very sad to see, while billion dollar scammers like Sam Bankman-Fried are spending New Years at his parents house.

NFTs go mainstream

NFT-technology has lead waves upon waves of mainstream adaptation of blockchain technology, mostly in the form of NFTs. We’ve seen legendary classic corporations such as Coca-Cola and the New York Stock Exchange entering the space. Reddit also made its way into NFTs by launching its Avatar Marketplace. The genius in their launch was not mentioning the technological aspect anywhere, bravo!

Norn was founded

In March 2022 Norn was founded. That’s right, during the worst year in crypto and Web3 so far, we decided to found Norn. It hasn’t been easy, and there’s been quite a few ups and downs, but we’ve survived and have a lot of exciting projects coming up during Q1 2023!

Top scammers and grifters 2022

A less positive list, but one we need to remember. These people exploited the opportunism of the space to a degree where both ethical and legal limits were crossed. We’re including this list so you can remember these people when they turn up with a new “Web3 project” in a few years.

Sam Bankman-Fried

The former golden boy of crypto, lobbying in DC and getting people like Tom Brady to yolo in hundreds of millions on crypto. SBF founded both FTX and Alameda Research and made what seemed like staggering progress in the space in both 2021 and 2022. SBF was on the cover of Forbes as the richest under 30-year-old and he was also well liked by Silicon Valley (like really well liked). In the FTX collapse it turned out however that FTX and Alameda had been commingling user funds this whole time and had lost north of $8 billion. Yes, imagine that they lost $8 billion of user funds and none of the people associated are in jail.

Do Kwon

The founder of Terra Luna, which collapsed in the spring of 2022, destroying a $50 billion dollar market cap within a few days. Do Kwon was notorious for his arrogance on Twitter (see Tweet in Terra Luna section). Interpol has issued an arrest warrant for Kwon, but seemingly have not been able to catch him yet. In the midst of the FTX collapse Kwon jumped on a livestream together with Martin Shkreli, Ledgerstatus and Cobie. Kwons approach has been forking Luna, and trying to build something new, but nothing has quite materialized yet.

Kyle Davies

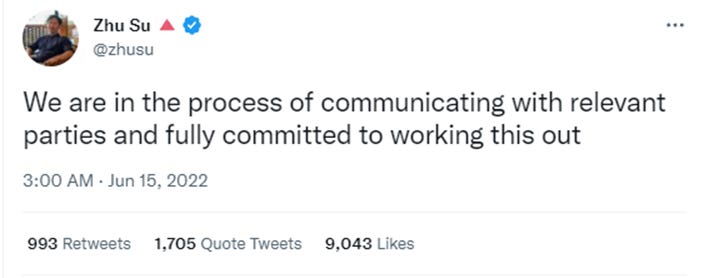

½ of Three Arrows Capital. Kyle Davies founded the hedge fund Three Arrows Capital together with long-time friend Su Zhu back in 2012. The hedge fund was mainly focused on forex trading, but switched focus to cryptocurrencies full-on in 2018. They managed to run it up to $18 billion (according to their last public statement), which is an impressive achievement. Unfortunately, they started commingling funds with partners, borrowing against collateral they didn’t have and finally defaulted on all of their loans. As it turns out, the $GBTC and Terra Luna trades were the final nails in the coffin for 3AC. Both Davies and his co-founder Zhu are still in hiding. They went silent after the collapse, with Zhu leaving the following infamous tweet as their final message:

In the middle of the collapse of FTX, both Davies and Zhu resurfaced on social media. One might say that it seemed they thought an even bigger crash would make people forget their reckless practices.

Su Zhu

½ of Three Arrows Capital. Same as above, just worth a separate mention.

Alex Maschinsky

The CEO and Founder of Celsius. Another multimillion bankruptcy that gambled with user funds. Celsius promised 7%-15% on deposited user funds (crypto). How did they achieve this? By lending out to institutions such as 3AC. Maschinsky branded himself as a genius innovator, claiming he invented Voice over IP (VOIP), basically internet based calls. This turns out to be completely false. He has filed a patent for something similar and worked at an early VOIP-company, but is not by any means the inventor. Remember this name if he comes back with a new business.

Kevin O’leary

While Mr. Wonderful didn’t outright scam anyone, he remains an avid supporter of Sam Bankman-Fried. O’leary was a paid spokesperson for and an investor in FTX, but as the company is in Chapter 11, it remains unclear why O’leary keeps defending Bankman-Fried. What is clear however, is that mr. O’leary is not to be trusted.

Logan Paul

One of the biggest influencers of our time, Logan Paul, who has worked hard on his comeback after filming a dead body in Japan and uploading it to his vlog in 2018 is now on the verge of getting canceled again. Investigative (citizen)journalist Coffeezilla has recently uploaded a three-part video series detailing Logan Paul's crypto project CryptoZoo and the shady practices that went on behind the scenes. After launch nothing that was promised has been delivered, and investors are still stuck with their egg NFTs and $ZOO tokens. It’s despicable for someone with the amount of reach that Paul has to use that to basically market a scam. Be aware of this grifter's business moves in crypto.

Some honourable mentions, rest of the FTX and Alameda core team

Caroline Ellison

The acting CEO at Alameda Research during the collapse. After Bankman-Frieds departure from Alameda Ellison ran the show together with Sam Trabucco. Trabucco also left in August 2022, whereafter Ellison took charge as CEO. While a lot of information is still being held from the public, Ellison has pleaded guilty to criminal charges and is cooperating with the SDNY.

Sam Trabucco

Sam Trabucco, also known as Tabasco, was co-CEO of Alameda Research with Ellison. Trabucco left Alameda Research in August 2022 and has not really been a (public) part of the FTX collapse. It is however almost certain that Tabasco was an active part in commingling FTXs user funds. In early 2021 Tabasco detailed the pivot in Alamedas strategy from delta neutral market making to basically taking directional bets, even on $DOGE in this Twitter thread. Some people speculate that this is where Alameda lost their edge.

Gary Wang

Sam Bankman-Frieds righthand man and the CTO at both FTX and Alameda Research at times. Like Ellison, Wang has pleaded guilty to criminal charges and is now cooperating with the SDNY in the case against Sam Bankman-Fried.

Top Accounts you should follow going in to 2023

Even though it was a horrendous year for crypto, we must not focus too much on the negative aspects. Here are some of the personas that have been bringing continuous informational value to the space regardless of the market conditions.

Bankless

Probably one of the most recognized media organizations covering crypto and Web3. Ran by Ryan Sean Adams and David Hoffman Bankless has several weekly shows and newsletters and we highly recommend you follow them for both interesting stories, great coverage and ofc the laughs.

Check out bankless here.

Coffeezilla

Coffeezilla is an investigative journalist who has been covering online gurus, scammers and grifters alike since 2019. During the crypto bullrun he followed the scammers and switched his focus to crypto. During the past year he has done insanely high quality coverage on Logan Paul, Sam Bankman-Fried, Celsius, BitBoy, Tether and more. He consistently posts high-quality content and goes deep in his investigations. We highly recommend that you add Coffeezilla to the people you follow in 2022.

Subscribe to Coffeezilla on YouTube here.

Laura Shin

A real OG in crypto journalism. Laura Shin started covering crypto in 2015 and now hosts the highly regarded Unchained Podcast. She has interviewed all the high profiles in crypto over 430 episodes of the Unchained Podcast.

Follow Laura Shin here.

DB (Tier10k)

The fastest and most up to date news for crypto markets on Twitter. DB somehow manages to post news seconds after they are released. We’re not sure how it works, but they’re always on it. We highly recommend you to follow them and put notifications on for them if you’re interested in closely following market moving news.

Follow DB here.

ZachXBT

Probably the best on-chain detective. ZachXBT frequently exposes scammers using on-chain data. ZachXBT has been a part of taking down countless scammers and public figures doing shady stuff in crypto, ranging from Floyd Mayweather to Jay Alvarez. ZachXBT has been so consistent in exposing scammers in the space that he has been mentioned in a press release by the Parisian police and legendary NFT artist Beeple decided to make him an honorary piece.

Follow ZachXBT here.

Cobie & Ledger

These two go under the same mention due to their joint venture; the UpOnly podcast. Cobie has been in the space since around 2012, while Ledger entered a few years after. The two of them do a great job of hosting a broad array of guests on UpOnly and they are also incredibly entertaining over on Twitter. Oh, and they also met for the first time this year! If you want to stay on top of what is happening, give them a follow.

Happy New Year!

Last but not least, we want to thank you, the readers! It’s been amazing starting this journey with you, and this is only the beginning. Thank you and a happy new year to all of you!